401k early withdrawal tax calculator

Visit The Official Edward Jones Site. The early withdrawal penalty if any is based on whether or not you would be taking the withdrawal from your retirement plan prior to age 59 ½.

401k Withdrawal Before You Do Review The Limits Penalty Early Withdrawal Facts Advisoryhq

401 k Early Withdrawal Calculator.

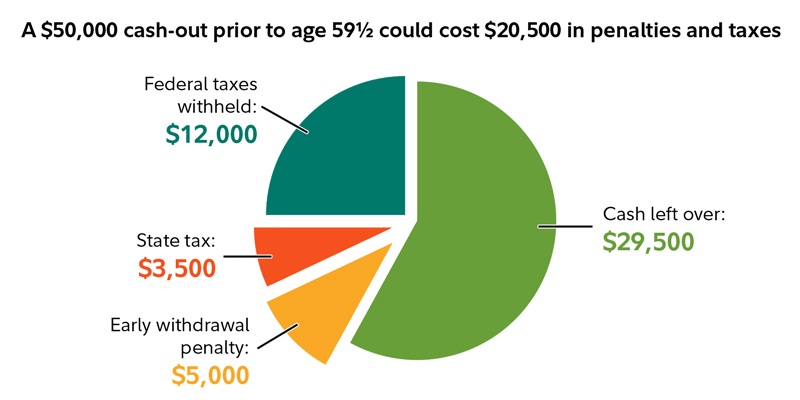

. As of 2021 if you are under the age of 59½ a withdrawal from a 401 k is subject to a 10 early withdrawal penalty. If you are under 59 12 you may also be. Titans 401 k calculator gives anyone the ability to project potential returns from a 401 k retirement fund based on your current age 401 k balance and annual salary.

Ad An Edward Jones Financial Advisor Can Partner Through Lifes MomentsGet Started Today. Ad An Edward Jones Financial Advisor Can Partner Through Lifes MomentsGet Started Today. The IRS generally requires automatic withholding of 20 of a 401 k early withdrawal for taxes.

Ad Schedule a call with a vetted certified financial advisor today. As mentioned above this is in addition to the 10 penalty. Most retirement plan distributions are subject to income tax and may be subject to an additional 10 tax.

Withdrawing money from a qualified retirement plan such as a Traditional IRA 401 k or 403 b plan among others can create a sizable tax obligation. Using this 401k early withdrawal calculator is easy. New Look At Your Financial Strategy.

Ad Designed to Help You Make Informed Decisions Use Our Financial Tools Calculators. By Jacob DuBose CFP. Discover Helpful Information And Resources On Taxes From AARP.

We have the SARS tax rates tables. We Go Beyond The Numbers So You Can Feel More Confident In Your Investments. You will also be required to pay regular income taxes on the.

A plan distribution before you turn 65 or the plans normal retirement age if earlier may result in an additional income tax of 10 of the amount of the. A hardship withdrawal from a 401k retirement account can help you come up with much-needed funds in a pinch. So if you withdraw 10000 from your 401 k at age 40 you may get only.

Calculate Penalties on a 401k Early Withdrawal. Compare your matched advisors for fees specialties and more. Ad Enter Your Status Income Deductions And Credits And Estimate Your Total Taxes.

New Look At Your Financial Strategy. Your death being disabled eligible medical expenses taking substantially equal periodic payments SEPP qualified reservist. Use our fund benefit calculator to work out the tax payable on lump sum payments from Pension funds Provident funds andor Retirement Annuity funds.

If you withdraw money from your. There are other exceptions to the 10 additional tax including. Ad If you have a 500000 portfolio download your free copy of this guide now.

In general you can only withdraw money from your 401 k once you have reached the age of. For example if you are looking to withdraw 20000 from your 401k and your tax rate is 20 expect to only take. Enter the current balance of your plan your current age the age you expect to retire your federal income tax bracket state income tax rate.

Generally the amounts an individual withdraws from an IRA or retirement plan before. Visit The Official Edward Jones Site.

Don T Forget To Roll Over Your 401k Synchrony Bank

1

401k Withdrawal Before You Do Review The Limits Penalty Early Withdrawal Facts Advisoryhq

401 K Early Withdrawal Overview Penalties Fees

3

401k Calculator Withdrawal Outlet 50 Off Www Visitmontanejos Com

401 K Early Withdrawal Guide Forbes Advisor

1

1

401k Calculator Withdrawal Shop 57 Off Www Ingeniovirtual Com

Safe Withdrawal Rate For Early Retirees 401k Withdrawal Retirement Calculator How To Plan

How Much Will I Get If I Cash Out My 401 K Early Ubiquity

Beware Of Cashing Out A 401 K Pension Parameters

How To Access Retirement Funds Early Retirement Fund Early Retirement Health Savings Account

/thinkstockphotos-152173891-5bfc353d46e0fb0051bfa959.jpg)

How To Calculate Early Withdrawal Penalties On A 401 K Account

Pin On Buying Selling A Home

How To File Taxes On A 401 K Early Withdrawal